Top 5 ways athenaOne helps your healthcare organization increase productivity

Many healthcare organizations are dealing with clunky, outdated electronic health records (EHRs) that waste valuable time that could be spent focusing on patients. On average, providers spend over 22 hours per week interacting with their EHR, often logging clinical data that could be automated or is actually redundant.1 Organizations of all sizes are struggling to document patient encounters efficiently, navigate complex payer requirements, reduce administrative tasks, and collect all of what’s owed.

But what if there was an all-in-one solution that could take on and manage work for your staff, so that your organization could save time and conserve resources?

athenaOne is your comprehensive solution that helps drive clinical efficiency, effective revenue cycle management, and care coordination, all while empowering patients and meeting their needs. Our intuitive and easy to use platform helps your healthcare organization to increase overall efficiency and productivity, so your staff can shift focus to patient care and retention.

Let’s take a closer look at exactly how athenaOne can help you achieve these goals for your organization.

Streamlined clinical and administrative workflows to reduce documentation time

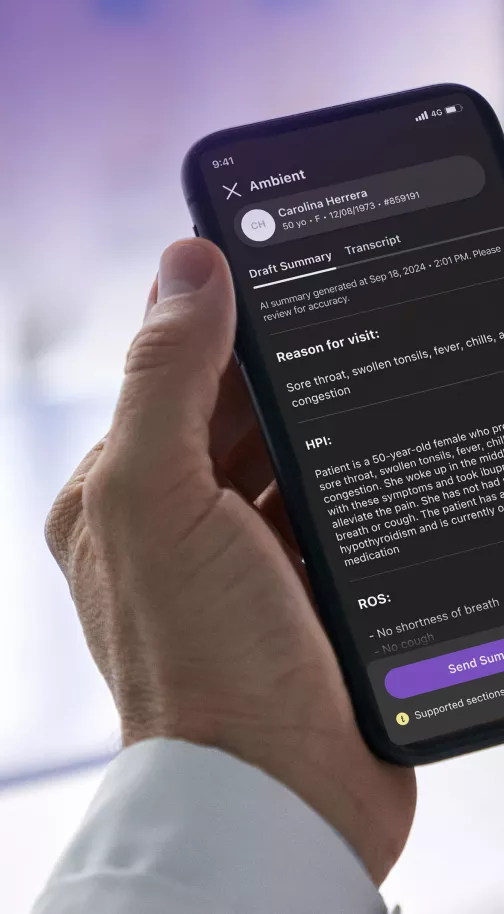

Rather than spending more time and energy in an EHR that adds unnecessary complexity to daily patient encounters, by using athenaOne, your organization can help streamline clinical documentation and reduce manual tasks. The platform offers intuitive interfaces and smart documentation tools that help enable clinicians to navigate seamlessly through patient encounters, capture relevant medical information, and generate comprehensive, efficient clinical notes. athenaOne also manages all incoming faxes and clinical documents with a combination of machine intelligence and expert review, so staff saves time on administrative work and can be re-deployed to higher value tasks.

athenaOne’s clinician-friendly documentation and intuitive workflows were designed specifically for how clinicians practice, supporting providers throughout the patient encounter – from pre-visit prep all the way through ordering and referrals. Helping save clinicians’ time, athenaOne allows your healthcare staff to focus on what matters most: delivering high quality care to patients.

Clinical decision support to provide informed care decisions and reduced care gaps

To help clinicians make more informed care decisions, improve care quality, and enhance productivity, athenaOne also incorporates clinical decision support (CDS) tools and resources that provide real-time, evidence-based guidance to clinicians at the point of care.

Alerts and helpful reminders for preventive care measures, medication interactions, and clinical guidelines help clinicians to deliver optimal care to patients while also reducing the time spent on research and decision-making. Care gaps and outstanding quality tasks are surfaced directly within the clinical workflow to help maximize efficiency. athenaOne offers pre-built order sets and templates that help guide providers in selecting appropriate tests, treatments, and interventions based on patient-specific criteria and clinical guidelines.

athenaOne’s analytics and reporting capabilities provide critical insights into clinical outcomes, quality measures, and performance indicators, helping your organization to increase effectiveness of clinical decision making and proactively identify areas of improvement.

Automated revenue cycle management to optimize revenue capture

In addition to helping your organization streamline clinical workflows, athenaOne features robust revenue cycle management (RCM) capabilities that optimize billing and reimbursement processes so you can collect more of what’s owed. In fact, practices that use athenahealth’s online payment solutions have a 44% higher patient pay yield than practices who don’t.2 By helping create efficiencies across the revenue cycle—from patient scheduling and intake all the way to patient payments and accounts receivable—the platform can help eliminate RCM pain points while also optimizing financial performance.

athenaOne automates key RCM tasks, such as claims submission, denial management, and payment posting, reducing manual effort and accelerating revenue cycles. athenahealth automatically checks patient eligibility before each appointment and again at check-in to verify a patient’s coverage and flag any issues right in the workflow, helping save time for front of office staff. athenahealth’s powerful medical billing rules engine contains over 30,000 billing rules3 to help proactively identify and reduce potential claim errors. athenaOne also features fast and accurate medical coding support from our team of experts, and our authorization determination engine helps check eligible orders against payer requirements to help alleviate administrative burden.

By streamlining revenue cycle operations, athenaOne helps healthcare organizations maximize revenue capture, minimize denials, and improve overall financial performance.

Financial performance monitoring to help you build long-lasting success

To help you take your organization’s performance to the next level, athenaOne offers robust analytics and reporting capabilities that provide insights into key financial performance metrics. Using the athenaOne Insights Dashboard, your healthcare organization can leverage this data to feel empowered with business insight, and help your organization grow.

athenaOne includes pre-built, real-time dashboards to track and analyze clinical, financial, and operational data to identify areas for improvement, optimize workflows, and enhance productivity. Customizable reports enable organizations to have high visibility into potential business challenges and areas of opportunity and use data-driven decision-making to help monitor productivity trends over time.

Data integration to enhance interoperability and care coordination

It’s extremely critical that internal and external providers’ systems communicate effectively and share valuable medical information. Interoperability is the cornerstone of seamless data exchange in healthcare, ensuring physicians have a full picture of their patient’s health and care journey.

athenaOne is a single-instance cloud-based solution that connects you with 56K+ lab and imaging sites, 62K+ pharmacy locations, 100 HIE/ACOs, 211 registries, and 88K provider sites, medical practices, and health systems, at no additional cost 4, ensuring that care plans, prescription information, lab results, and other critical data is shared quickly and efficiently.

athenaOne’s data integration and interoperability mean that your organization’s care teams can proactively spot care gaps and get ahead of potential obstacles for patients. When your solution serves up the right information at the right time, clinicians are enabled to make timely, accurate care decisions more efficiently.

By providing streamlined workflows, integrated data, revenue cycle management capabilities, clinical decision support, and analytics tools, athenaOne empowers enterprise healthcare organizations to increase efficiency, improve productivity, and deliver high-quality care.

Learn how athenaOne can help drive efficiency and productivity for your healthcare organization.

- Medical Economics, “Physicians Spend 4.5 Hours a Day on Electronic Health Records”, April 2022, https://www.medicaleconomics.com/view/physicians-spend-4-5-hours-a-day-on-electronic-health-records

- Based on athenahealth data as of Dec. 2023. Patient Pay Yield (PPY) is the percentage of patient balance collected within 6 months of the date of service; M046

- Based on athenahealth data as of Mar. 2024; M017

- athenahealth network data as of Q2 2023