Lab results. When newborn babies finally start sleeping through the night. What foods can help alleviate leg cramps. Surely patient portals have improved communication with doctors and cut down on phone calls back and forth for years. But new healthcare data show a promising correlation between portal technology and patient payment behaviors that increases the convenience factor for both — and supports financial sustainability for care providers.

A new athenahealth Research and Insights report from March 2020, “Trends in Patient Pay,” finds patients are increasingly paying their medical bills online and on time. The study analyzed data from July 2017 through the end of 2019, across all types of insurance coverages and self-pay. The percentage of patient obligation dollars paid using mobile technologies increased 63% in that period, likely owing to millennials and generation Z increasingly using their phones as lifestyle management tools — although Baby Boomers also contributed to the ascent in overall total mobile collections. In separate data from across athenaNet, it’s estimated that 45% of all patient payments are digital — a number sure to keep rising thanks to enhanced technology and office staff trained to encourage digital engagement.

Key findings from our analysis of 158 million claims for 33 million patients across several specialty areas — primary care, pediatrics/adolescent medicine, OB/GYN, gastroenterology, orthopedics, orthopedic surgery, general surgery, cardiology, and urgent care — include:

A rise in digital payments across all age groups and insurance types

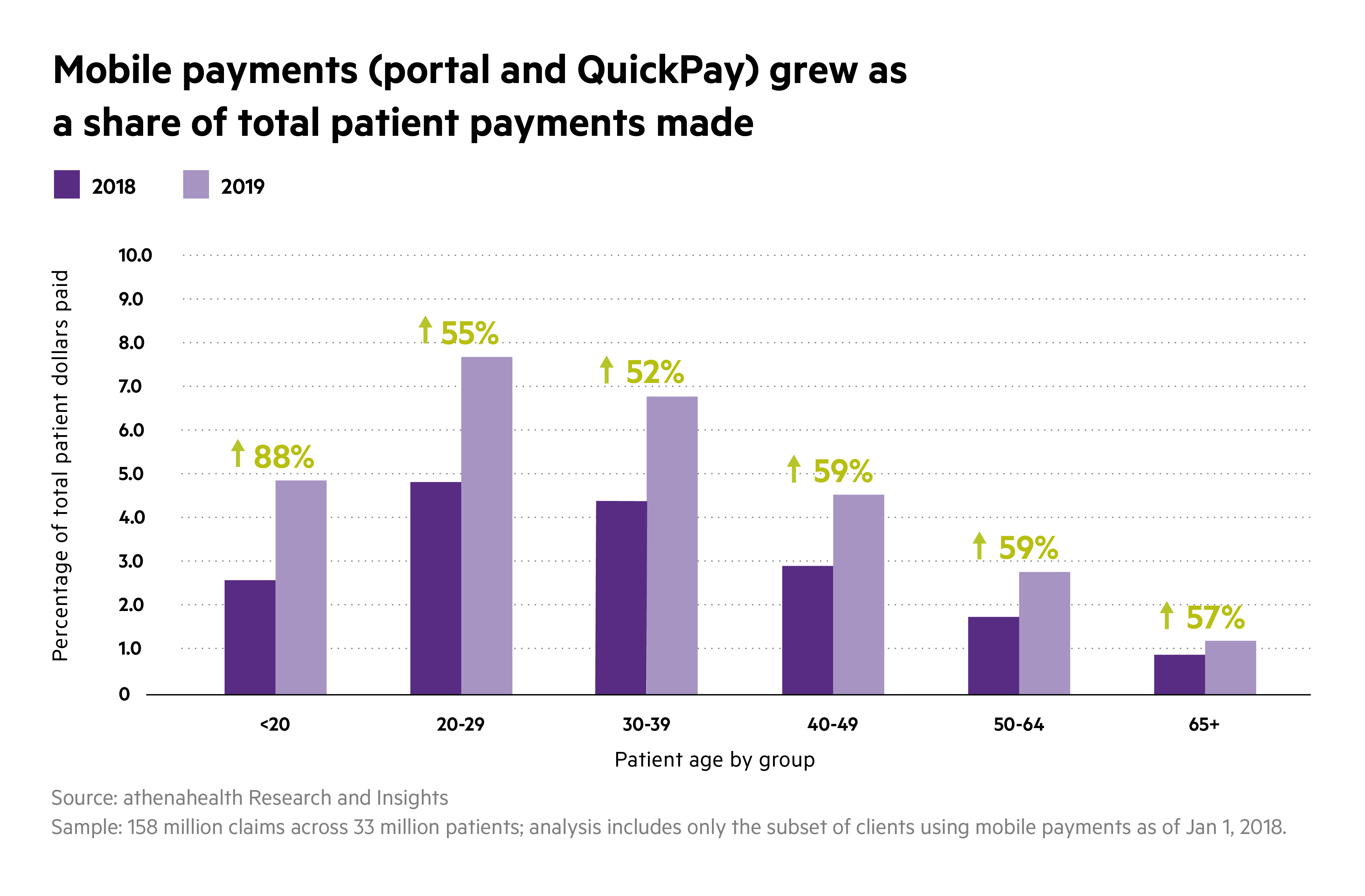

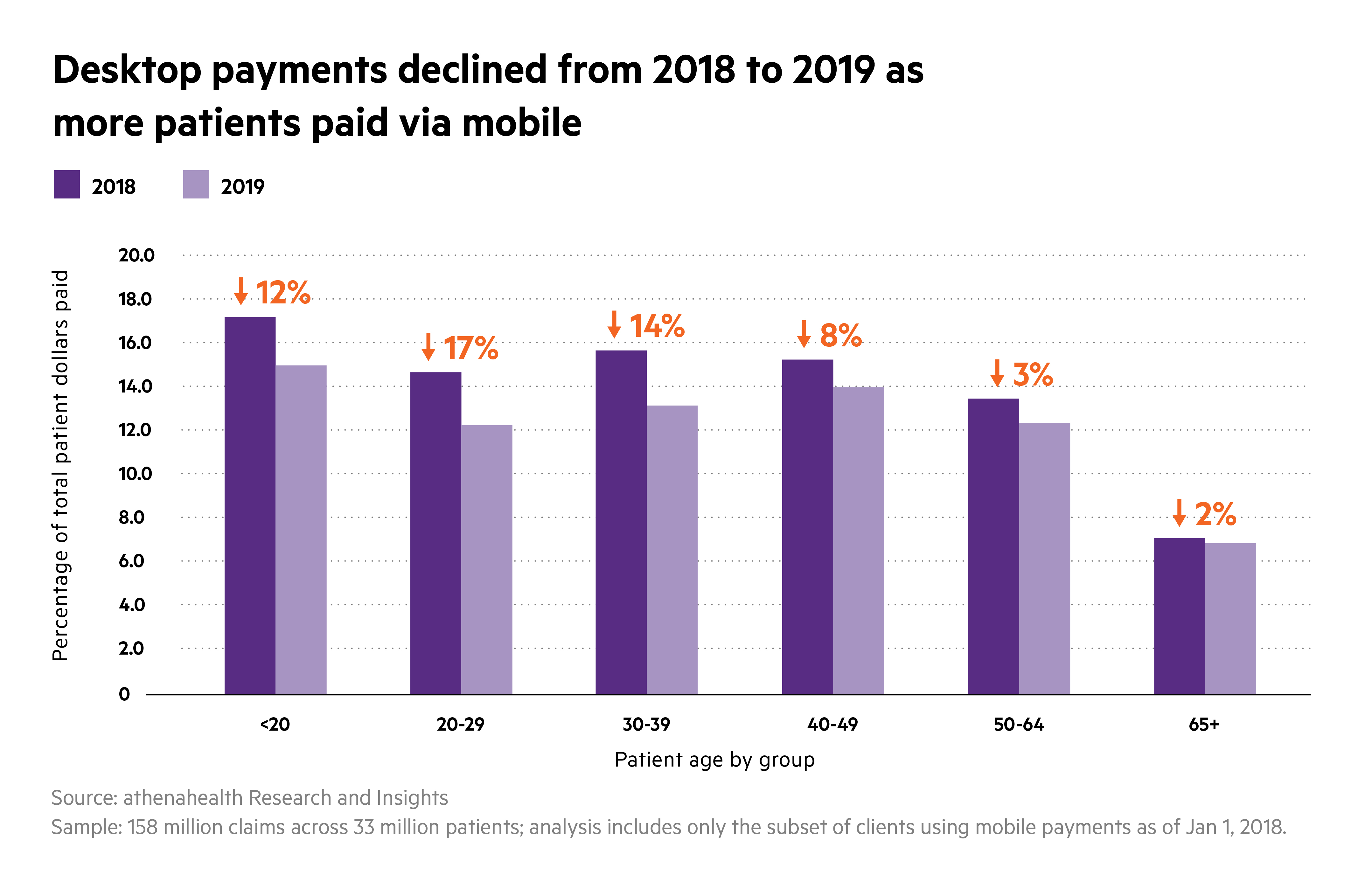

As the number of options to make online payments has increased, so has adoption. Across all demographics and generations, electronic payments as a percentage of total patient dollars paid increased by 6 percent, and it increased across all insurance types (commercial, Medicaid, traditional and Medicare Advantage, and self-pay patients). Desktop payments declined for all age groups, but the decline was steepest for those in their 20s and 30s — who not surprisingly increasingly use their mobile phones as tools. Baby Boomers and their older counterparts also show an increasing willingness to pay via mobile device, as the total percent of dollars paid by patients ages 65 and older via mobile increased by 75 percent between 2018 and 2019.

As mobile options are calculated using both portal and quick-pay (no login) options, it’s clear that ease of use is one key factor encouraging behavioral shifts. Separate data garnered from an athenahealth survey of 18 million patients whose providers are on the cloud-based network found that 91 percent of patients pay in full and on-time when they can pay without logging into a portal. In a landscape where patients are increasingly prosumers — blurring the lines between producer and consumer — and crave the convenience of one-stop shopping, new options offer speedier “checkouts” much easier than licking stamps or waiting on calls to billing offices. Payments are made four times faster using athenahealth’s Guest Pay compared to other payment methods, data separate from the Insights report show. Or, should patients agree, secure portal technologies can store log-in information, which means after registration there’s no need to remember or re-enter a password every time — much like the capabilities of online retail giant Amazon.com.

How requests for payment are issued by providers could also contribute to practices’ success. Issuing online electronic statements that directly link to e-payment options, for instance, cuts down on paperwork for both office staff and those they help care for. Data from across the athenahealth network from March 2020 reflects an 85 percent full payment rate when guest pay options are utilized.

Profitability opportunities and wins

Patient payment obligations are a major component of financial performance for providers, making up more than 18 percent of allowable charges in 2019 — so it’s essential to not only get paid, but to enable collection of those payments as quickly as possible. “Trends in Patient Pay” reflects good news for providers, as the percentage of patient obligation dollars paid within six months rose in all categories evaluated except for orthopedics. In a bright spot for patient obligation, other athena network data show that the patient liability for overall allowable charges from insurance companies rose just 7% in the report’s 30-month window.

Across the athena network, data show a 5 percent increase in patient yield among practices that increase patient population portal adoption by at least 15 percent. Increasing portal adoption may rely as much on training office staff on prompts when interacting with patients as on patients adopting such technology themselves. Such staff members are often responsible for co-payment collections at time of service, which the Insights Report shows has remained largely unchanged in terms of collection within six months of the visit. Co-pay collection remained high across the board for several specialty areas, at 92 percent overall.

The highest percentage of overall online payments made was in pediatric/adolescent medicine, at 30 percent of all patient dollars paid. This is likely due to the fact that patients’ share of payments is smaller than in other areas of healthcare, and data show that payment balances that are smaller are paid faster. Millennials, who by and large grew up with the Internet, are now also growing their families, and were among the first to adopt online and mobile portal payment tools in healthcare.

“Trends in Patient Pay” data in this article is based on deidentified, aggregated data from athenaNet between July 2017 and 2019.