As an obstetrician/gynecologist in private practice for nearly a decade, Amber Shamburger, M.D., knows what it takes to get patients to pay their bills. For one, she says, it helps to be flexible: $20 a month through a long-term payment plan is better than no payment at all.

But even more important for her business is the work her staff does ahead of each visit, before a patient even walks through the door.

“We try very hard to avoid surprises," says Shamburger, who owns Friendswood Women, an ob/gyn practice with two locations in suburban Houston. Most of Friendswood's patients, she explains, “have no idea what kind of insurance they signed up for, and they're usually unaware they chose a high-deductible plan."

To reduce potential sticker shock when a patient is asked to pay, someone from her team will call the person's carrier to make sure they have the relevant numbers in advance.

“If it's a new patient or if they have new insurance, we get the company on the phone and find out everything we can. How much is their deductible? How do sick visits factor into it? Does everything go toward the deductible, or is it only when they're in the hospital?"

With that information in hand, Shamburger says, it's easier to collect patient payments upfront. “I think it's better for everyone that way — not only for the patient, but also for us. They know what their bill is going to be, and can be prepared for it if it's going to be big."

On the practice's end, when they deliver a service, “we know that we're going to be paid for what we did."

The impact of patient debt

As high-deductible health plans become more and more common, patients aren't the only ones feeling the impact on their wallets. Many medical practices struggle with high deductibles, in part because patient debt can be so difficult to collect.

According to recent research by the Kaiser Family Foundation, more than half of patients with employer-sponsored health plans have annual deductibles of $1,000 or more for single coverage, while nearly a quarter (23 percent) are enrolled in plans with deductibles topping $2,000 per year. The problem for medical practices, of course, is that patients with high deductibles may be responsible for the cost of their care, but there's no guarantee they're going to pay their bill.

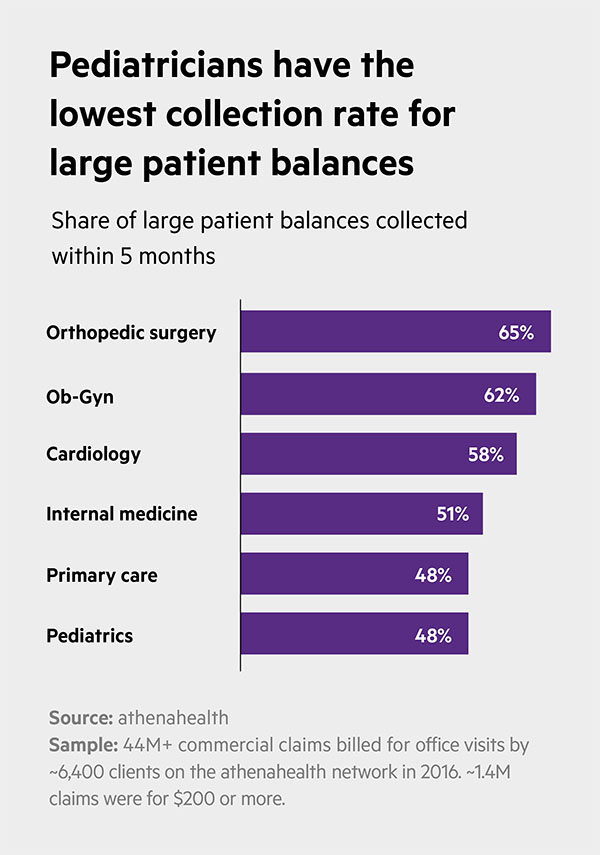

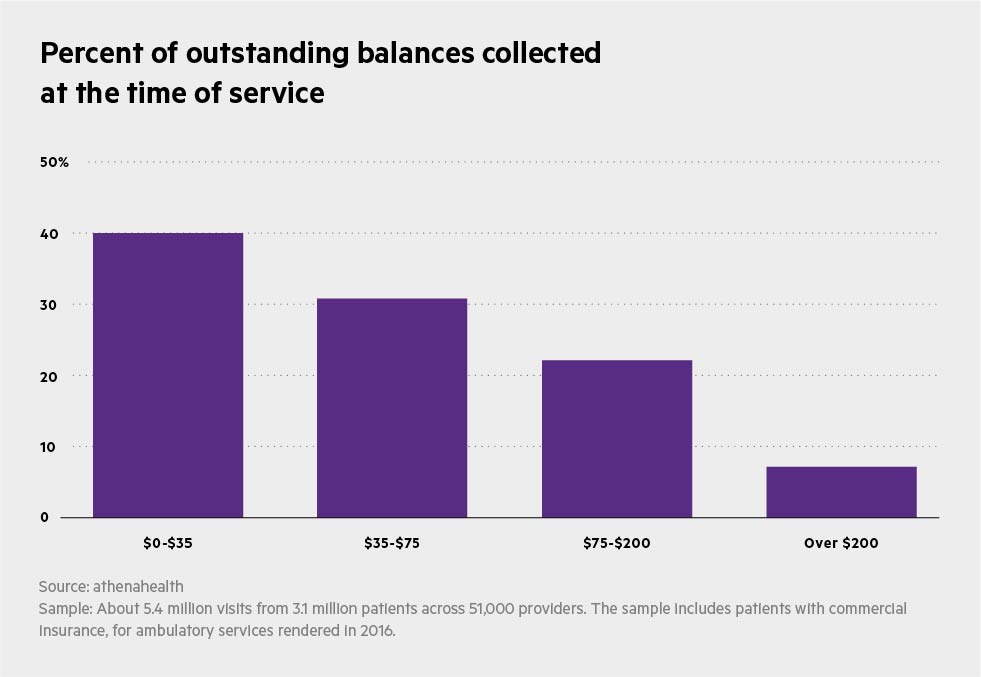

In fact, athenahealth data show that medical practices of all specialties struggle when it comes to settling patient obligations. One 2016 analysis, for example, found that providers who saw commercially insured patients collected just 12 percent of what they were owed at the time of service, and in two out of three visits collected nothing upfront at all.

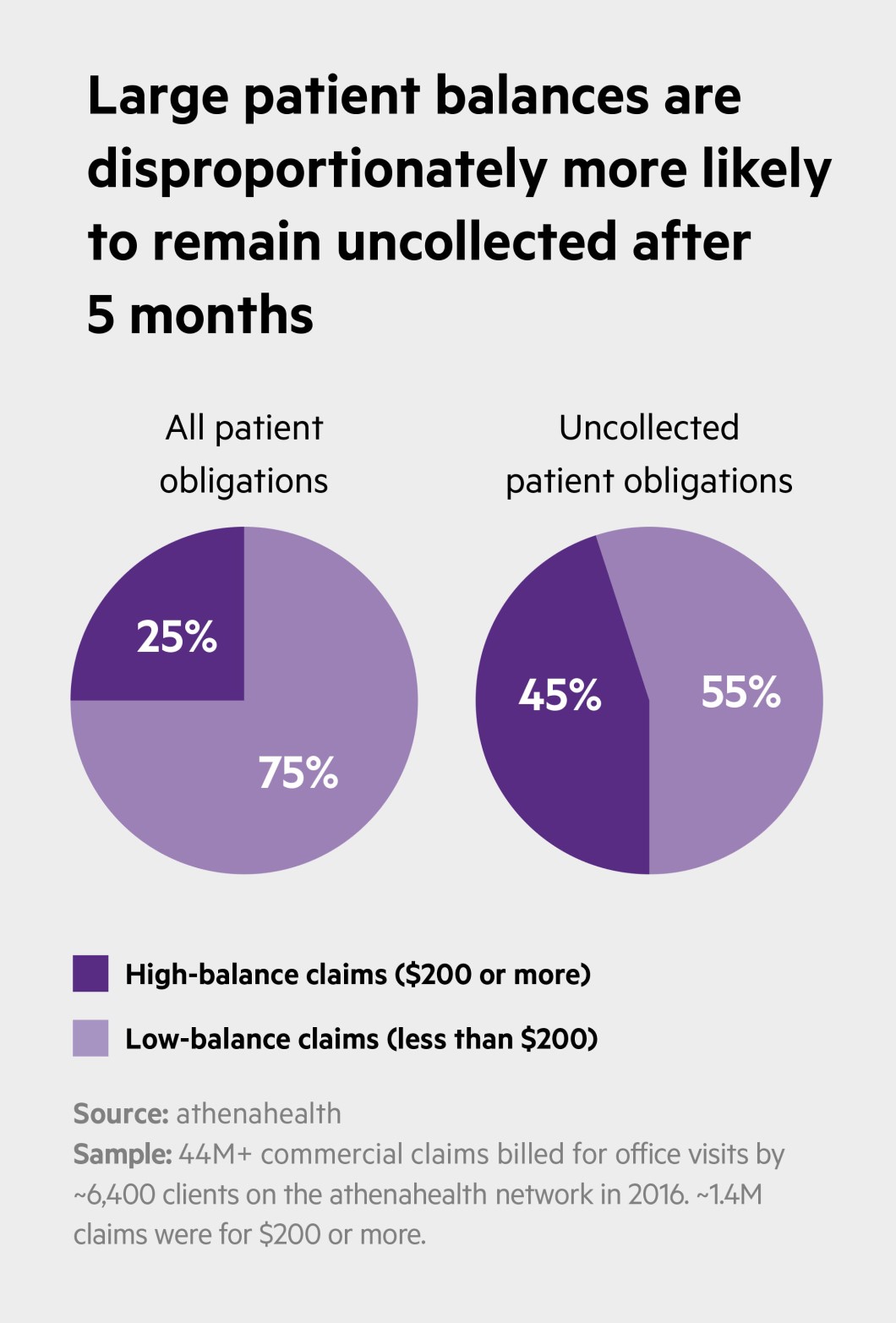

And the higher the patient balance, the harder it is to collect: A second athenahealth survey revealed that 45 percent of commercial patient obligations that remain unpaid after five months are for claims of $200 or more.

While some providers might consider non-payments an unavoidable cost of doing business, unresolved patient debt becomes difficult to ignore when seen in the context of practice finances overall: High-balance claims, according to athenahealth data, make up less than 4 percent of total claims where the patient is responsible for payment, but account for 25 percent of potential patient revenue.

“In the old days we left a lot of money on the table," says Michael J. Behr, M.D., medical director and physician emeritus at OrthoAtlanta in Georgia. The practice does its best to avoid that today because patient responsibilities “are much more significant now and more important to our practice."

Strategies for success

Like the team at Friendswood Women, Behr and his colleagues at OrthoAtlanta, which includes 14 offices in the Atlanta area, work hard to ensure patients are aware what will be expected of them when they come in for care. “We have a very strict policy, particularly with surgeries, about getting payment upfront," Behr says. The group has learned over the years, he adds, “if you don't capture payment at the time of service, you're just not going to get it."

If you don't capture payment at the time of service, you're just not going to get it.

The key to OrthoAtlanta's success in this regard are its patient account representatives, Behr says. “They're our frontline people, the ones patients talk to if they have concerns about insurance or need to make payment arrangements. They answer questions, and the main thing is, they're always considerate. They treat our patients like customers and try to give them a good experience."

That focus on the patient as customer can go a long way in a healthcare environment where costs are on almost everyone's mind, agrees Robin Brand, senior director of revenue cycle research at Advisory Board, a Washington-based healthcare research and consulting company. “Especially as deductibles continue to grow and patients have to pay more for their care, it's important to see things from their perspective."

Toward that end, Brand suggests, practice managers should consider the financial questions their patients are most likely to ask: “How much am I going to have to pay?" “Why should I have to pay at the point of service?" “What does this bill even mean, and how can I pay it?" It sounds pretty simple, Brand admits, but anticipating a patient's concerns and then “proactively responding" in a clear and concise way “is much better than leaving them in the dark."

The “patient financial experience," Brand adds, may not be as important as the quality of care itself, but it's certainly critical to any provider's bottom line. “High-quality healthcare is expensive, and everyone knows it, and that's not going to change anytime soon."

Patients are generally willing to pay for what they get, she says, but they want the terms spelled out in ways they can understand – just as they would for any financial transaction. “Give them options and tell them everything they need to know, and there won't be any surprises in the end."

Chris Hayhurst is a writer based in Northampton, Massachusetts.