Learn how athenahealth enables more efficient revenue cycle management in healthcare

Healthcare organizations today face significant challenges when it comes to reimbursement and payment, the rising costs of supplies and services, regulatory and compliance costs, and of course, physician burnout and high turnover rates.

According to a recent report from Beckers Hospital Review, among the top five challenges for revenue cycle teams in 2024 are timely patient collections (48%), managing denials (36%), and hiring and training staff (32%).1 These challenges pose serious threats to the long-term viability and sustainability of many practices, making it even more difficult for certain practices to keep their heads above water.

athenahealth can help your practice proactively manage and defend against these prevalent revenue cycle challenges—with RCM solutions that empower practices of all sizes to get the data and insights they need to drive better practice management and maximize financial performance. In this article, we’ll show you how to use athenaOne® Insights Dashboards to track financial success metrics, gain quick and easy snapshots of your practice’s financial health, and get help from our experts to take revenue cycle and medical billing work off your plate.

Use Insights Dashboards to get a snapshot of practice performance and effectively measure growth

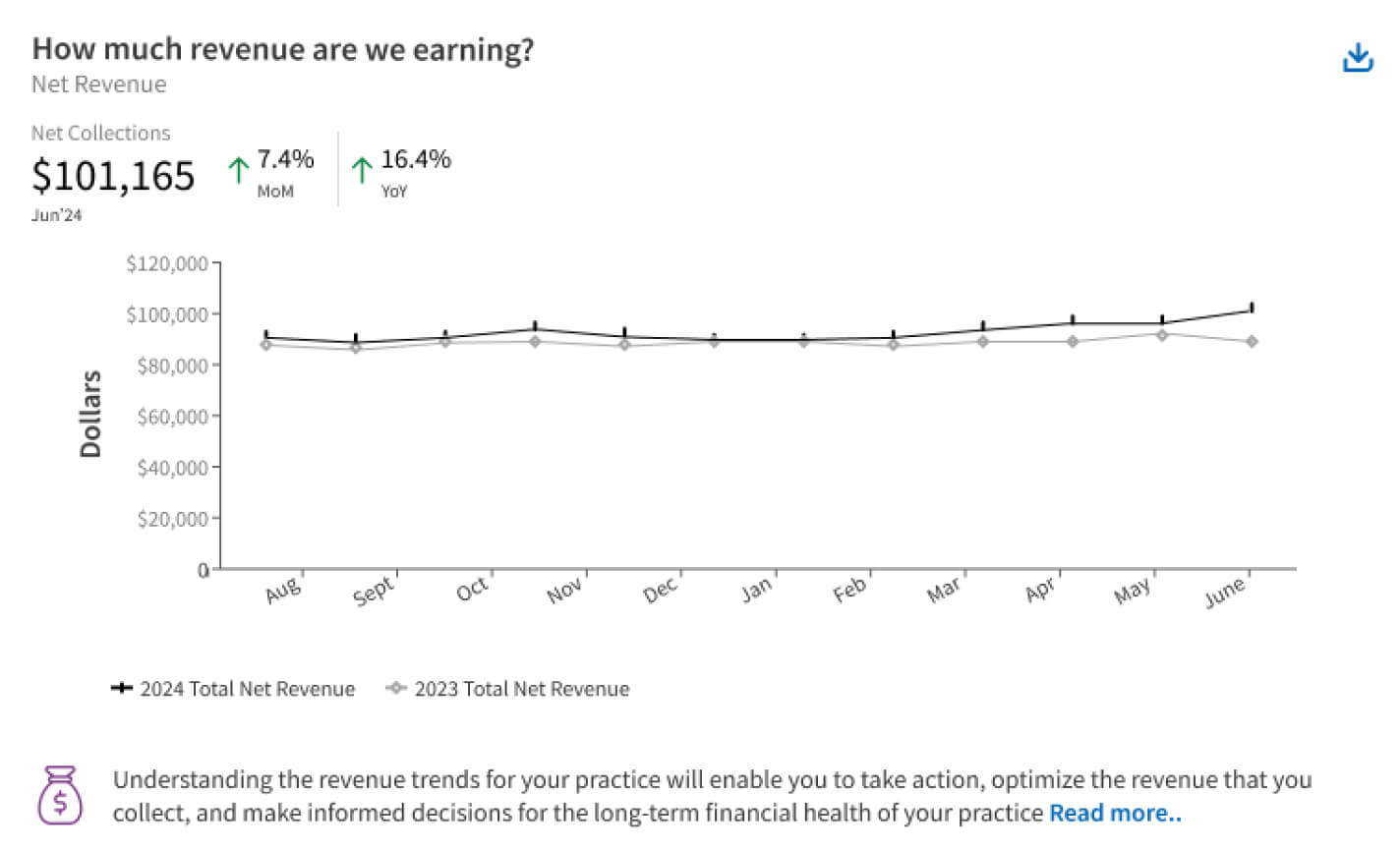

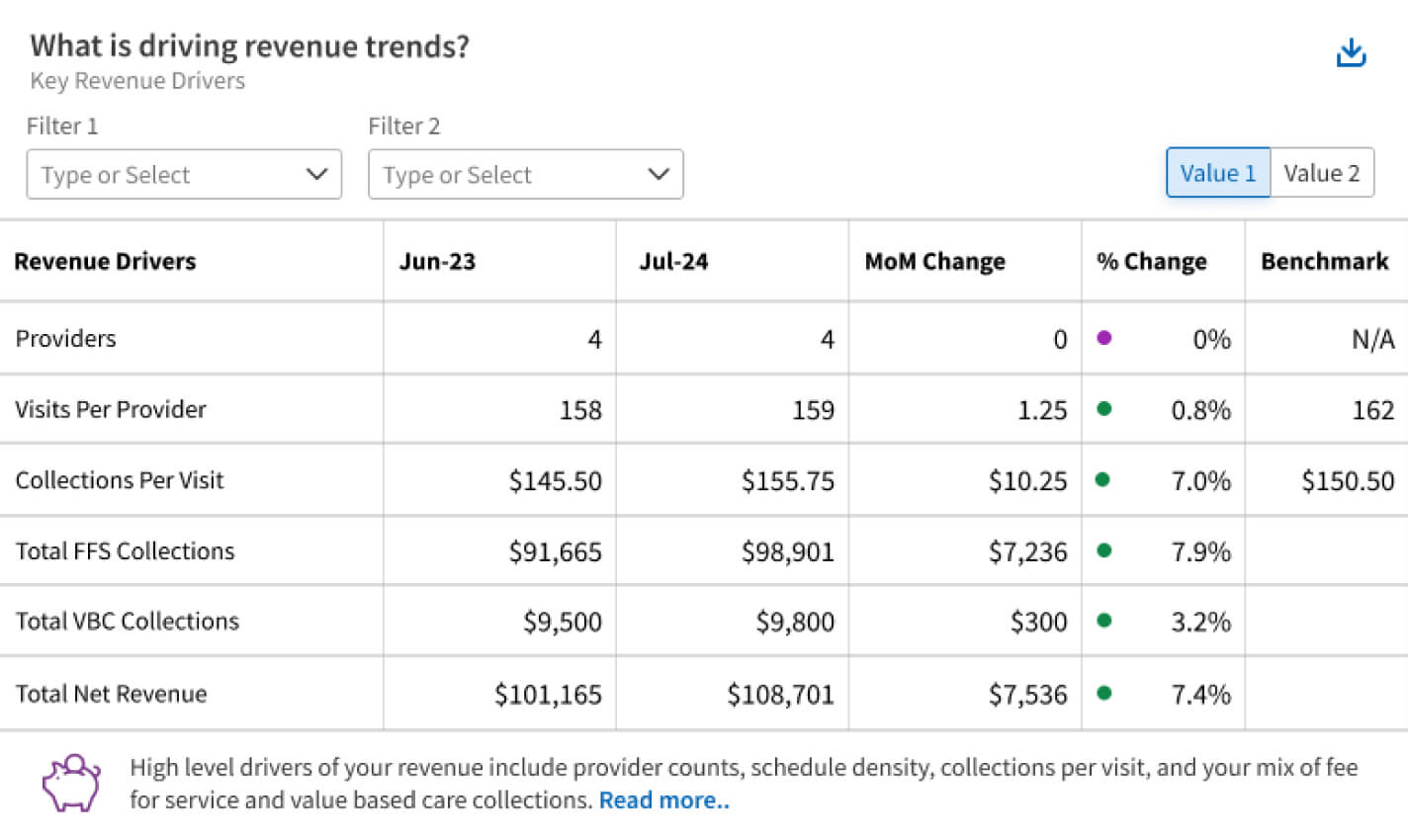

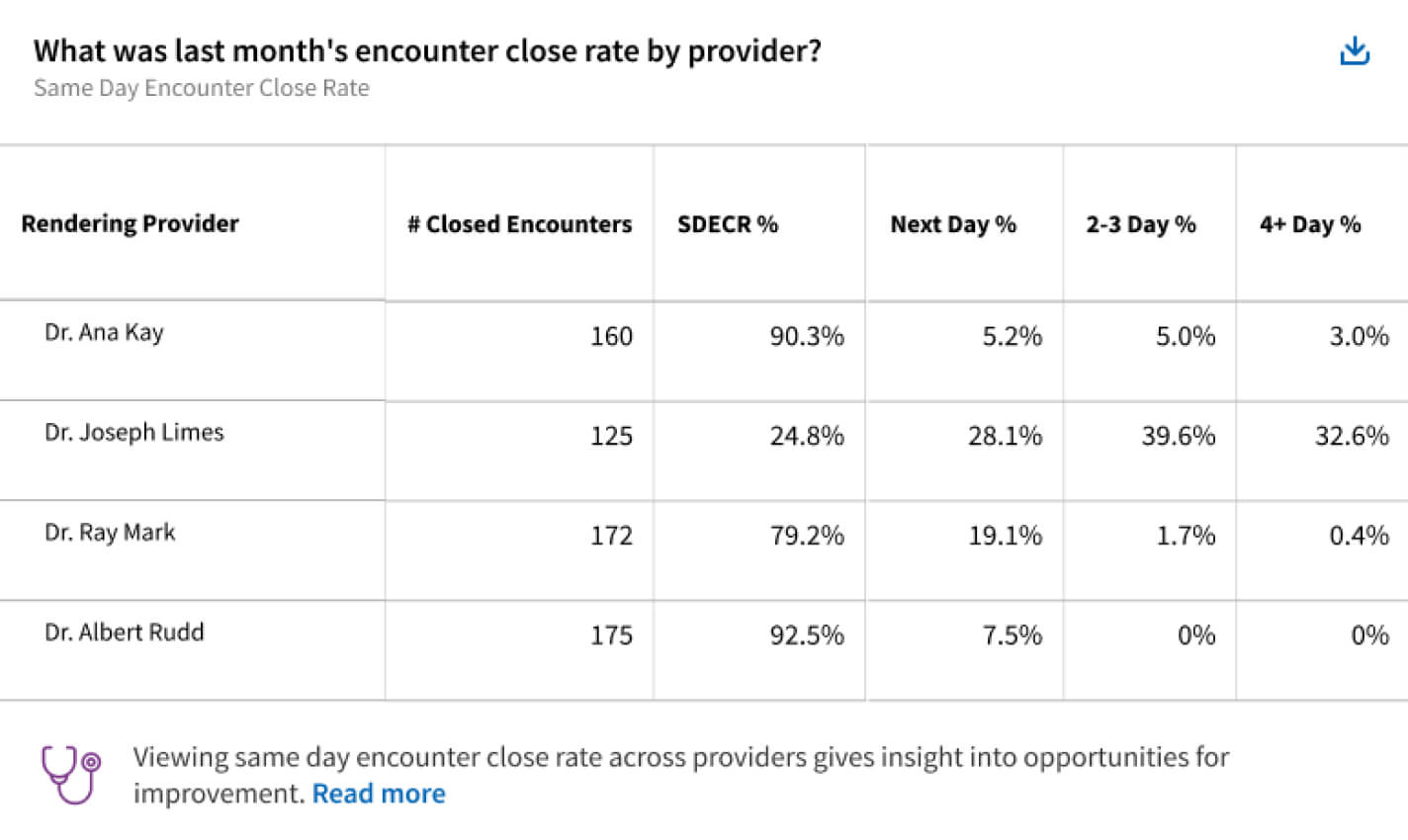

Get a clear picture of financial performance and actionable advice using customizable Insights Dashboards. These dashboards use helpful graphs and charts to track data on overall revenue, collections, visit volume, and more, giving you real-time insights on how your practice can optimize the revenue cycle.

Here are the top metrics in Insights Dashboards that your practice can leverage to better understand your financial health and identify focus areas for improvement.

1. Collections posted and Charges posted – Collections help measure the amount of cash received each month, regardless of when those services were provided. Similarly, Charges measures the amount of charges (cash due) in the past month and is a leading indicator of future collections. You can track these metrics month over month and year over year in your dashboard.

2. Total Visits – This metric helps your practice track the total number of visits month over month (MoM), year over year (YoY), or trailing twelve months (TTM). If your practice’s Total Visits are trending down this year compared to last, you will see this called out in the dashboard to help you identify ways to drive more revenue.

3. Total RVUs (Relative Value Units) and Total RVUs per visit – This is a national standard metric for representing the relative amount of physician work, resources, and expertise needed to provide services to patients. An increase in total RVUs over time indicates revenue growth, while a change in total RVUs per visit might happen if your practice has expanded into new specialties or services, medical coding has changed, or the patient panel has changed.

4. Schedule utilization – This metric, along with the number of cancellations and no-show rates, will help your practice determine if there are any gaps in your patient schedule that can be filled, helping to increase your collections and total visits. If your schedule is underutilized, or you have a high number of cancellations, Insights Dashboards will suggest ways to see more patients like conducting patient outreach and follow up.

5. Number of new vs. existing patient appointments – A helpful way to measure your practice’s flow of patients, number of new vs. existing appointments can help you determine if patient self-scheduling tools are working well for your practice. If the number of new appointments scheduled has stagnated since last month, consider increasing awareness of patient portals and self-scheduling tools to help patients stay engaged and on top of their wellness.

Insights Dashboards can help your practice better understand practice performance KPIs through curated tables and metric views. Using these interactive charts, tables, and insights panels, your practice can take a data-driven approach to revenue cycle management and develop long-term strategies like creating practice management improvement plans, financial benchmarks, and revenue targets.

Success metrics for practices using fee-for-service and value-based care models

Nearly half (47%) of physicians at healthcare organizations incorporating a mix of both fee-for-service and value-based care (VBC) payment models feel that their organization is more financially secure.2

In general, having multiple methods of collecting payment can help practices remove limitations around following only one kind of payment model, and can therefore lead to revenue growth. The metrics tracked in Insights Dashboards can be used to help practices using a mixture of both fee-for-service and value-based care payment models.

For example, tracking patient pay yield (PPY) can help both fee-for-service and value-based care practices monitor patient payments, while metrics like cancellation rate, no show rate, and reschedule rate can give insight into patient engagement and loyalty, both critical measurements when it comes to VBC.

“You don’t feel like you’re alone when you have athenahealth’s revenue management system. There’s always someone there to help you, there’s great benchmarking, and there’s great back-end intelligence.”

- Cindy Buchman, Good Shepherd Rehab Network

How athenahealth can help you optimize practice management and enhance financial performance

By automating tasks like insurance selection, claims creation, denial management, and prior authorization, we’re helping practices reduce their administrative workloads, speed up claims processing, and improve financial outcomes. Here are just a few ways athenahealth can help your practice reduce administrative burden and improve overall financial health.

1) Remittance matching and denial research – We handle these complex tasks, recommending the best actions for quick resolution to help your practice resolve denials quickly and easily. Our co-sourcing model leverages athenahealth billing experts to help improve financial outcomes while providing visibility into your revenue cycle, helping you eliminate billing frustrations and allocate resources where they’re most needed.

2) Auto Claim Create – This tool can help reduce charge entry lag and the time it takes to submit claims to insurance. This not only helps your practice improve cash flow by speeding up claims submission but also cuts down on the recurring administrative tasks that often overwhelm staff. Additionally, our claims scrubbing experts help monitor payer policies and denial trends, applying the most up-to-date information to reduce future denials and accelerate payments.

3) AI-powered insurance selection – Integrated directly into athenaOne, AI-powered insurance selection works by processing a picture of the patient's insurance card through a machine learning model that analyzes the image, extracts information from the card, and pairs it with patient data to recommend the correct insurance. This feature can help save your practice valuable time on manual insurance entry.

4) athenaPatient™ – Help your patients to submit digital payments for services quickly and without the headache via the athenaPatient app. Our user-friendly design helps alert patients when a payment is due, saving your billing teams time and effort.

5) Customer Success Managers – Practices can partner with a Customer Success Manager to design customized Insights Dashboards, helping you determine which financial performance metrics are most important to you. Customer Success Managers can also help you monitor overall practice performance and set revenue goals and key milestones.

6) athenaIDX™ – Your practice can benefit from patient estimation, quality registration, prepayments, financial assistance programs, rules-based and itinerary-driven scheduling, eligibility-specific copay/coinsurance/deductible collections at the point of service, and robust follow up care coordination, all with athenaIDX. These key features help your organization to collect the right amount at the point of care, saving you time and money.

For many practices, it can be difficult to know where to start when tracking and improving KPIs for practice performance. athenahealth is here to help. Using insights from the athenaOne network and curated Insights Dashboards, practices can work to improve financial outcomes over time.

With the right performance metrics and real-time analytics, practices can make informed, data-driven business decisions, set benchmarks for success, and proactively monitor data for potential business challenges. athenahealth helps you focus on delivering high-quality care while achieving financial success, so you can succeed and grow. Learn more about how your practice can get started with Insights Dashboards to effectively measure practice growth.

1. Beckers Hospital Review. (January 2024). The biggest challenges facing revenue cycle departments in 2024. Retrieved Feb 2025 from https://www.beckershospitalreview.com/finance/the-biggest-challenges-facing-revenue-cycle-departments-in-2024.html

2. 2024 Physician Sentiment Survey commissioned by athenahealth and fielded by Harris Poll.