Get the most critical KPIs to power up revenue cycle management and activate practice growth

A successful medical practice relies on critical data to help them track financial performance and practice growth, with many practices leveraging revenue cycle management tools from their EHR to measure performance over time.

However, recent data shows that less than half (42%) of physicians surveyed feel that their healthcare organization is on solid financial footing, leaving the majority feeling that their practice’s financial performance is at risk.1

The fact is, many practices still struggle to get the information they need to accurately and proactively track practice performance, with some unable to effectively manage their revenue cycle and stay on top patient payments, payer denials, medical billing, and more.2

Having the right metrics at their disposal can help practices to better analyze and understand their overall financial health and also tackle longer-term financial challenges that may persist year over year. But what are the specific metrics that practices should be tracking on a regular basis? And which KPI are the critical “vital signs” to help measure a practice’s financial performance?

To help answer these key questions and enable practices to better succeed with revenue cycle management (RCM) in healthcare, we’ll provide an overview of the most important metrics to track for successful practice management.

Less than half (42%) of physicians surveyed feel that their healthcare organization is on solid financial footing, leaving the majority feeling that their practice’s financial performance is at risk.

Why are performance metrics critical for a financially healthy practice?

Without insights into overall practice performance, healthcare organizations remain in the dark about claims approvals, patient payments, overall collection rates, and more, preventing them from proactively identifying financial gaps and challenges. This can lead to larger, more persistent performance issues down the line. Proactive measurement of financial performance can help your practice better understand where you might be leaving money on the table, where you can speed up the RCM process, and the overall cost of business.

Let’s take a closer look at which metrics are the most important for tracking your practice’s overall financial performance.

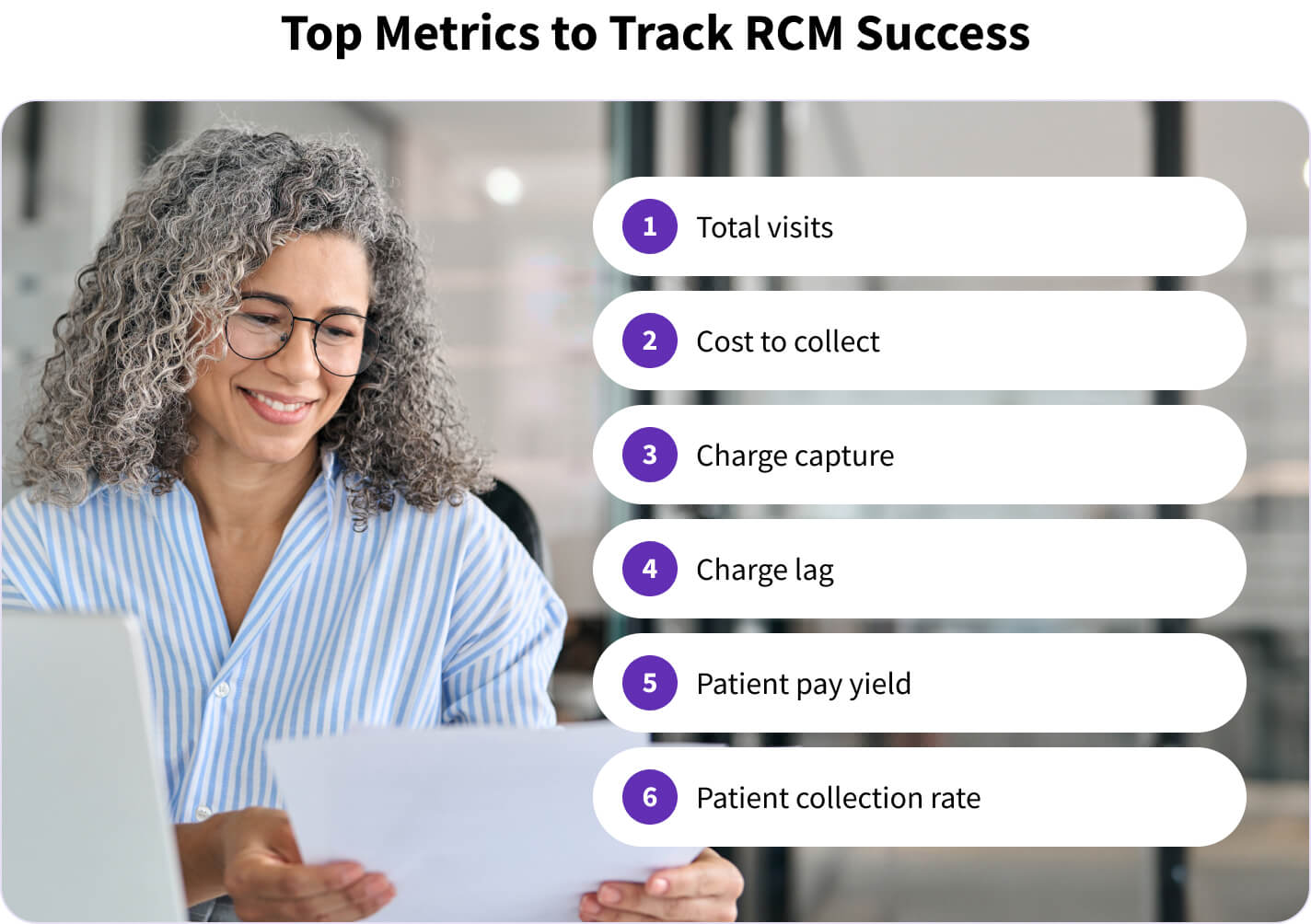

Top 6 metrics to track for healthcare revenue cycle management

To gain further insight into key financial elements like the flow of patients through the door, overall collections, and patient payments, doctor-owners and practice managers should work to identify which key metrics they can regularly report on. For a more accurate picture of your practice’s financial health, consider leveraging the six RCM metrics below.

- Total visits – this volume metric helps your practice track your total number of patient visits on a monthly, quarterly, or yearly basis. This metric also helps provide a sense of schedule density and how well providers are being utilized.

- Cost to collect – indicates how much your practice is spending on average for patient billing, medical billing, and revenue cycle management overall. This metric can help you understand how efficient your RCM process is, and if it might be time to examine new ways of lowering costs.

- Charge capture – this metric helps you identify chargeable services rendered during patient care. It helps your practice understand if you’re accurately capturing all services rendered during patient visits, and if any chargeable services could be falling through the cracks.

- Charge lag – reflects the number of days between when a patient receives care and services are provided, and when the charge is entered into billing. This metric can help you determine how efficient your medical billing process is and if claims can be created sooner, speeding up your cash flow.

- Patient pay yield (PPY) – this metric indicates the amount of patient payments a practice is collecting on average. It can be an integral way for practices to understand how much they’re collecting in revenue from payments that are the patient’s responsibility.

- Patient collection rate – measures the rate of patient balances collected by your practice. A low patient collection rate is a warning sign that your patient billing and collections might need to be optimized.

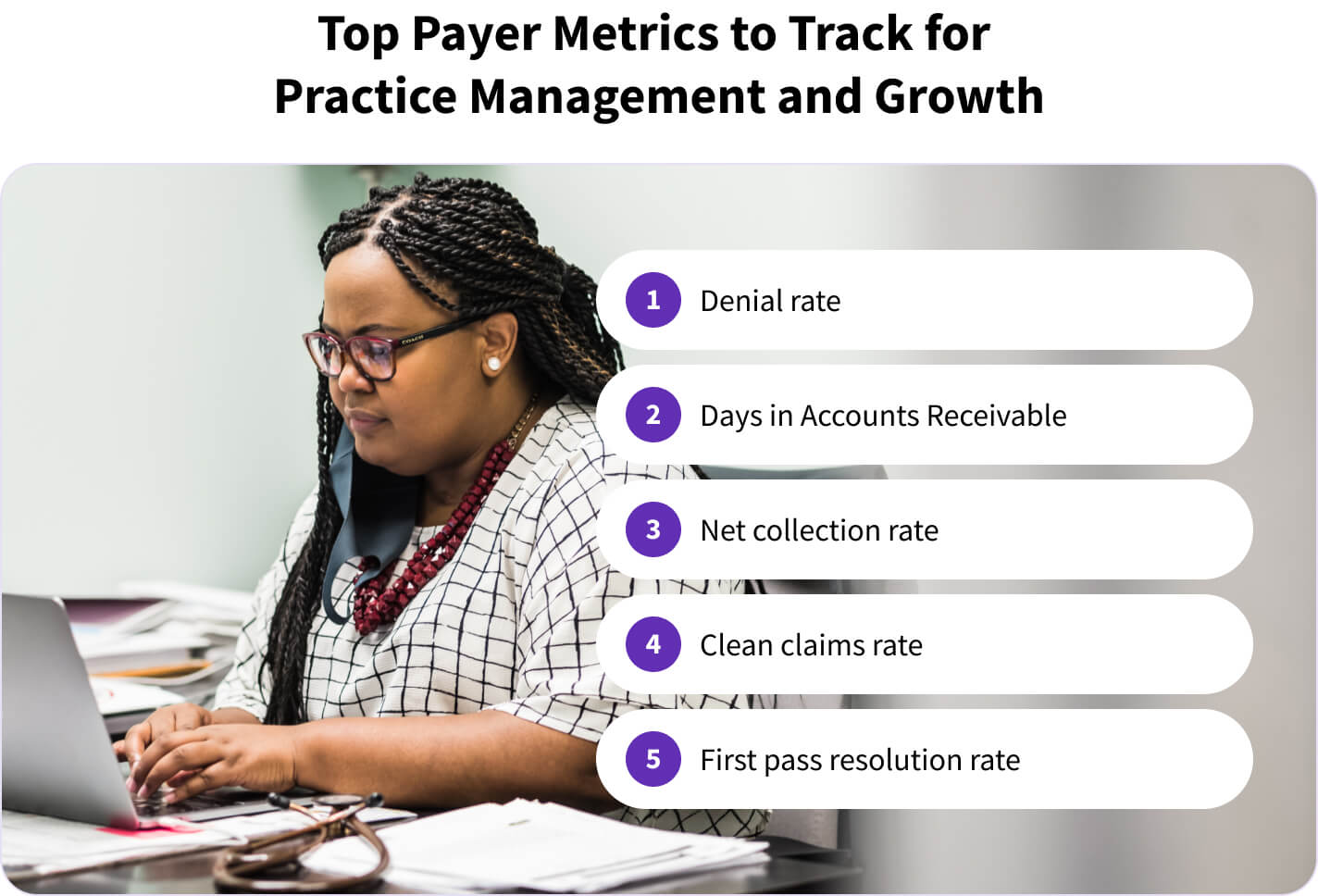

Payer specific metrics to track for practice management and growth

Aside from the revenue cycle metrics listed above, it’s also beneficial for practices to examine critical metrics related to payers. These metrics can help paint a picture of the overall payer-provider relationship and give insight into crucial phases of the healthcare revenue cycle, like medical coding and claims submission. Insight into the below payer-specific metrics can help your practice drive efficiency, save time on denial management, and collect more.

- Denial rate – indicates what percentage of claims are denied by the payer. A higher denial rate could mean that your practice needs to optimize the medical coding or claims submission process, or that prior authorization may be needed for certain patients.

- DAR (Days in Accounts Receivable or A/R Days) – this key metric measures how long it takes, or the average number of days, for a practice to receive payment for services provided. The higher the number of days in A/R, the more likely your practice is to have cash flow issues.

- Net collection rate (NCR) – the percentage of collections after write-offs and is separate from gross collection rate. This metric reveals how much your practice is collecting from the payer. A low net collection rate can mean that your practice might have more medical coding errors and more claim denials.

- Clean claims rate – this reflects how many of your medical claims are accurate and processed correctly, which is critical in the payer-provider relationship and can help you determine if there are efficiencies to be made in medical billing and coding.

- First pass resolution rate (FPRR) – this metric helps your practice measure the percentage of claims that are submitted to the payer correctly and processed on the first round of review. Incorrect medical coding and a high denial rate will likely lead to a lower FPRR.

It can be difficult to know where to start when tracking and improving KPI for practice performance, or where to focus efforts to improve your practice's overall financial health. To stay prepared, healthcare organizations need a solution that gives full visibility into financial performance, with tools and features that help them proactively stay on top of medical billing and practice management challenges before they become a larger issue.

athenahealth can help your practice take these steps towards simplified billing, increased financial performance, cleaner claims, and more efficient practice management. To learn more about how your practice can collect more, faster, take a look at our guide to better revenue cycle management. Read on in part two of this article to discover how athenahealth can give you real-time insights into financial performance and help take on administrative burden related to RCM so your practice can focus on quality patient care.

- 2025 Physician Sentiment Survey of 1,001 physicians nationwide, commissioned by athenahealth and fielded by Harris Poll.

- NIH. (July 2, 2024). Revenue Cycle Management: The Art and the Science. Retrieved Feb 2025, from https://pmc.ncbi.nlm.nih.gov/articles/PMC11219169/